건강/건강식품

🚀빠른배송 위 점막 수복 성분 건위 작용이 있는 생약을 배합한 위장약. 거칠고 손상된 위 점막을 복구하고 약해진 위를 정상으로 되돌립니다

라면/컵라면

🚀빠른배송 면, 쯔유, 재료에 새롭게 「시치미(7가지 맛의 향신료)」를 추가하여, 우러난 국물의 맛을 더욱 돋보이게 합니다.

구강/면도

🚀빠른배송+2 잇몸 질환 (치은염 · 치주염) 예방하며 치료가 높은 소금 치약입니다. 잇몸에 직접 작용하는 짠 크리스탈 소금을 배합. 썬스타 소금치약

건강/건강식품

🚀빠른배송 라이온 페어아크네 24g 일본 여드름 연고 는 성인 여드름 및 피부 트러블을 빠르게 완화하는 일본 인기 여드름 치료제입니다.

🚀빠른배송 바삭한 식감을 즐길 수 있는 스틱 타입의 감자 과자입니다. 찐감자와 당근, 파슬리를 넣어 재료 그대로의 맛을 느낄 수 있는 샐러드 맛.

건강/건강식품

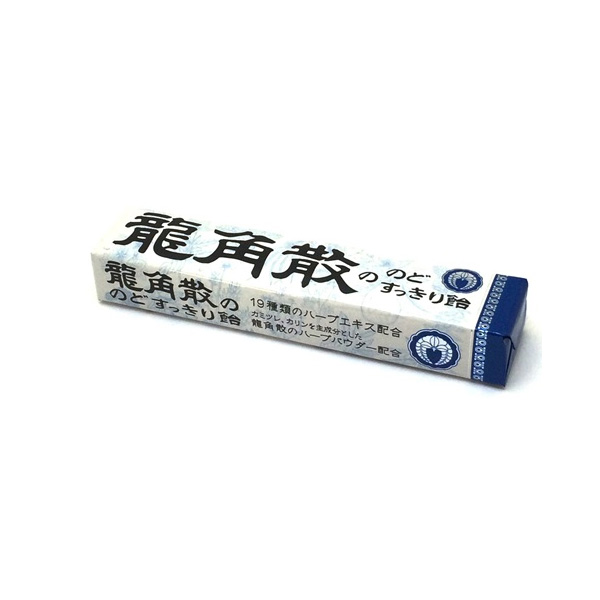

🚀빠른배송 용각산 목캔디 오리지널 스틱캔디 10정 은 목에 좋은 19가지 허브추출물을 배합한 용각산 목캔디입니다. 목의 칼칼함, 답답함, 졸음 예방등에 효과가 있습니다.

🚀빠른배송 가루비 자가리코 감자버터맛 55g 는 바삭한 식감을 즐길 수 있는 스틱 타입의 감자 과자입니다. 감자의 풍미에 감칠맛 나는 훗카이도산 버터를 사용해 버터스러움 UP!

🚀빠른배송 가루비 자가리코 치즈맛 55g 은 바삭한 식감을 즐길 수 있는 스틱 타입의 감자 과자입니다. 찐감자에 체다치즈와 까망베르 치즈를 넣어 짭쪼롬한 치즈의 맛과 부드러운 뒷맛을 즐길 수 있습니다.

건강/건강식품

🚀빠른배송 자외선에 의한 눈의 염증을 억제하며 타우린이 함유되어 피로한 눈을 깨끗하고 상쾌하게 만들어주는 안약입니다.

건강/건강식품

🚀빠른배송 샤론파스 Ae 레귤러 사이즈 240매입은 일본 대표파스, 혈액순환을 촉진하는 비타민E 함유 (흰색 컬러)

식품(빠른배송)

🚀빠른배송 가루비 자가리코 명란버터맛 52g 은 감자 스틱 스낵으로, 진한 명란과 고소한 버터의 풍미가 어우러진 인기 간식입니다.

🚀빠른배송 다이어트식품 및 간식으로 적합한 오리히로 저칼로리 곤약젤리를 무려 한봉지에 세가지 맛으로 만날 수 있습니다.

🚀빠른배송 오리히로 곤약젤리 파우치 청포도맛 6개입 은 신선한 마스카트 포도의 상큼한 맛과 곤약젤리의 쫄깃한 식감이 조화를 이루는 인기 있는 일본 젤리입니다.

라면/컵라면

🚀빠른배송 쫄깃한 굵은 면발에 야채의 단맛이 나는 마일드하고 걸쭉한 카레스프. 재료는 감자튀김, 고기, 당근, 파가 들어있습니다.

🚀빠른배송 오리히로 곤약젤리 파우치 망고+백도 12개입 240g 은 망고, 백도 2 종류의 맛을 즐길 수 있는 유익한 모음 타입 입니다.

건강/건강식품

🚀빠른배송 아네론 니스캡 멀미약 10정은 일본 대표 멀미약, 효과 빠르고 지속1회 복용으로 최대 24시간 효과와 멀미 예방 및 완화 (승차, 항해, 항공 멀미)구역질, 어지러움 해소멀미 발생 후에도 증상 완화1일 1회 복용으로 지속적인 효과를 유지 합니다.

견과/건과/안주

🚀빠른배송 패밀리마트 구운 오징어 소면 14g 오징어를 건조시켜 맛을 응축하고, 오징어 본래의 맛을 이끌어 내기 위해 구이했습니다.

건강/건강식품

🚀빠른배송 페어 아크네 크림 W는 여드름균에 의한 코메도(흰색 여드름)의 생성을 억제하고 붉은 여드름을 가라앉혀 모공 속부터 여드름을 치료합니다

🚀빠른배송 파인 파인애플 아메 사탕 캔디 110g는 일본에서 오랫동안 사랑받아온 인기 사탕으로, 새콤달콤한 파인애플 맛이 특징입니다. 일본 브랜드 Pine Co., Ltd.에서 제조했으며, 진한 파인애플 향과 상큼한 단맛으로 어린이부터 성인까지 모두에게 인기입니다.

🚀빠른배송 진한 돼지기름 간장 베이스 – 깊고 고소한 세아부라 풍미고급 간장 사용 – 숙성 간장으로 감칠맛 극대화생면 같은 탄력 있는 면발 – 닛신 특유 라멘 스타일 면맛있는 토핑 – 건조 챠슈, 대파, 멘마 포함간편 조리 – 뜨거운 물만 부어 5분 만에 완성

빠른배송

🚀빠른배송 아사히 민티아 칼피스는 일본 아사히에서 출시한 설탕 무첨가(Sugarless) 민트 태블릿입니다.상큼한 칼피스 맛과 민트의 청량함이 조화를 이루며, 칼피스 특유의 새콤달콤한 맛과 민트의 상쾌한 조합이 매력적인 인기 아이템입니다.

🚀빠른배송 메이지 타케노코노사토 죽순 초코과자 는 일본 메이지에서 출시한 인기 초콜릿 스낵으로, 바삭한 쿠키 위에 부드러운 밀크 초콜릿과 다크 초콜릿이 2층으로 코팅된 독특한 과자입니다. 대나무순 모양을 닮은 귀여운 디자인과 함께 달콤하고 바삭한 식감이 특징입니다.

과자

🚀빠른배송 세븐일레븐 고구마겐삐는 100% 큐슈산 고구마 사용,자연 그대로의 고구마 풍미바삭한 식감 , 갓 튀긴 듯한 크리스피한 식감자연스러운 단맛 ,인공 감미료 없이 깔끔함간식 & 다과용 – 차, 커피와 잘 어울림고구마 본연의 건강한 맛

건강/건강식품

🚀빠른배송 산테FX V 플러스 12ml 안약은 비타민 · 아미노산 등의 영양 성분을 비롯한 7 종의 유효 성분을 충실 배합 했습니다.

🚀빠른배송 하우스 바몬드 카레 중간 매운맛 230g 은 사과와 꿀이 더해진 달콤하고 감칠맛 있는 일본식 카레부드러운 식감으로 어린이·어른 모두 즐기기 좋음물만 넣고 끓이면 완성되는 간편 조리고기·야채와 잘 어울리는 깊은 풍미12인분(6인분 X 2팩) 대용량 구성 됩니다.

건강/건강식품(빠른배송)

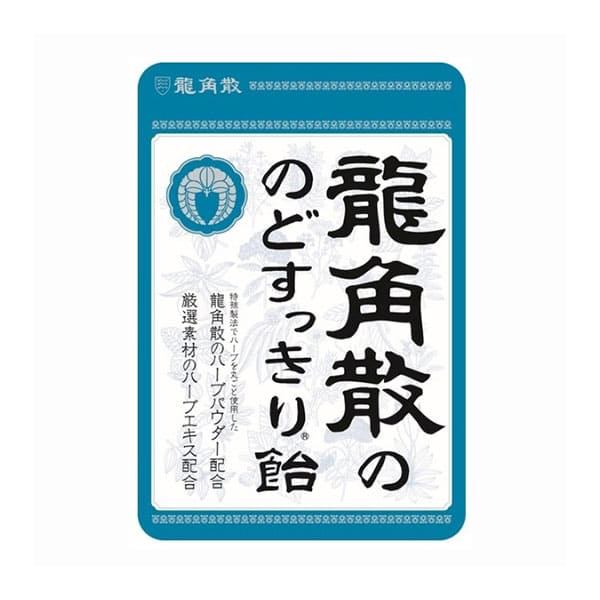

🚀빠른배송 카밀레, 칼린을 주성분으로 한 용각산의 허브 파우더에 가세해, 19종류의 허브 엑기스를 배합했습니다. 목 친화적 인 목 사탕입니다.

건강/건강식품

🚀빠른배송 로토 C큐브 아이스쿨 안약 13ml 눈의 피로 해소 – 장시간 스마트폰·PC 사용 후 효과적,강력한 쿨링감 – 청량 레벨 7단계 중 6단계,건조함 개선 – 수분 보충 및 보호막 형성,렌즈 착용 시 사용 가능 – 소프트/하드 렌즈 모두 OK

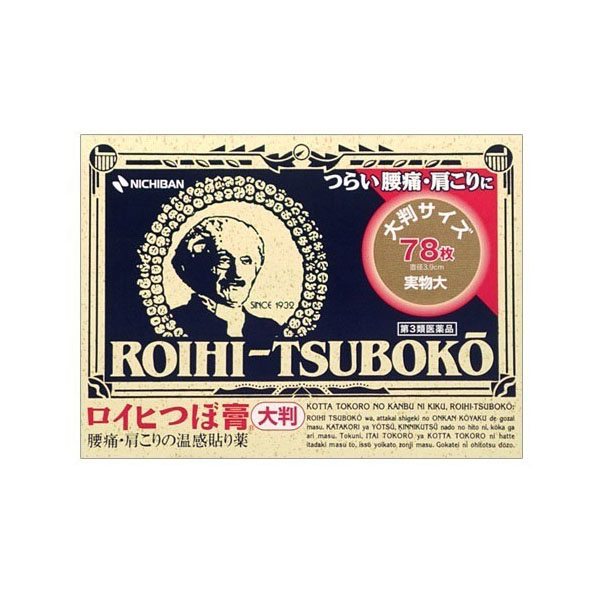

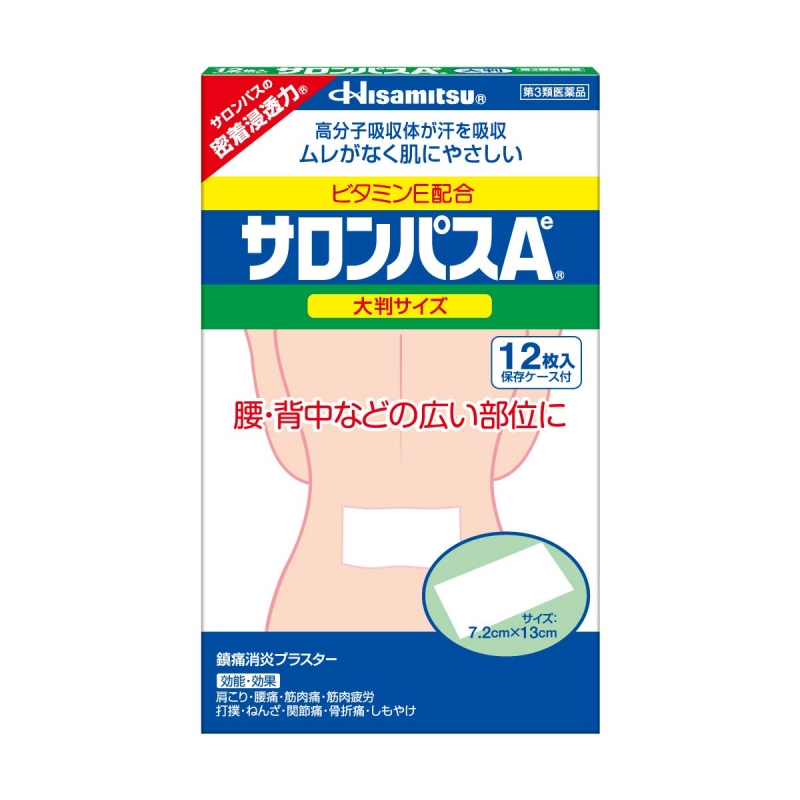

건강/건강식품

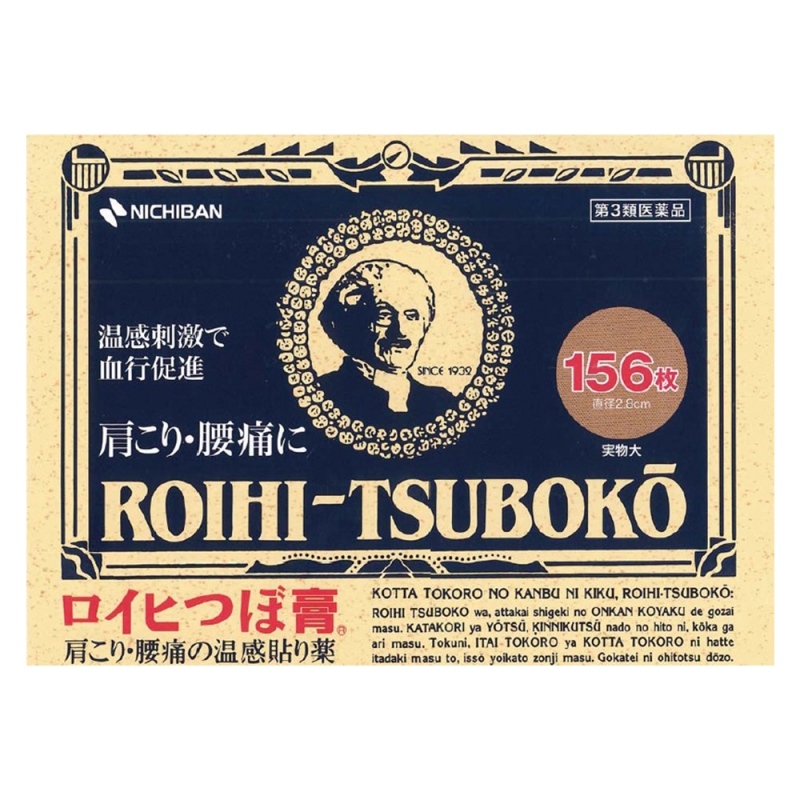

🚀빠른배송 빠른 통증 완화 – 근육통, 허리통증, 어깨 결림 등 효과적대형 사이즈 (7.2cm × 13cm) – 넓은 부위에 적합쿨링 효과 – 바르는 즉시 시원한 느낌 제공피부 자극 최소화 – 땀 흡수, 쾌적한 사용감비타민 E 함유 – 혈액순환 촉진으로 통증 완화

건강/건강식품(빠른배송)

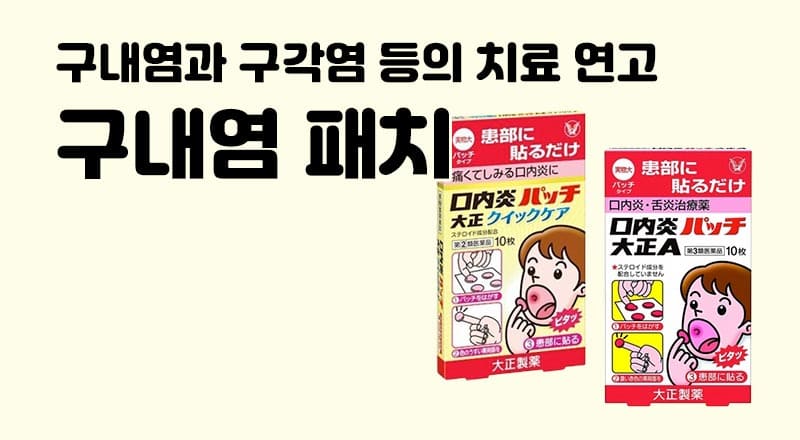

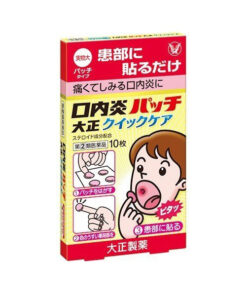

🚀빠른배송 구내염·구강 궤양 치료염증을 빠르게 완화하고 회복을 돕습니다. 빠른 진통 효과스테로이드 성분으로 통증 부위를 신속 진정시키며 강력한 밀착력침에도 쉽게 떨어지지 않고 장시간 지속 가능하고간편한 사용붙이기만 하면 끝! 휴대도 간편음식 섭취 시 불편함을 줄여주는 일본 인기 구내염 패치

라면/컵라면

🚀빠른배송 고소한 참깨 & 땅콩 향, 매콤하면서 부드러운 감칠맛, 탱탱한 면발 식감, 얼큰한 고추기름 국물, 한국인의 입맛에도 딱 맞는 깊고 매콤한 라멘! 일본 정통 탄탄멘 스타일 – 깊고 진한 스프, 참깨 & 땅콩 베이스 육수 – 고소함과 매콤한 고추기름 조화, 쫄깃한 생면 식감